BACK

BACK

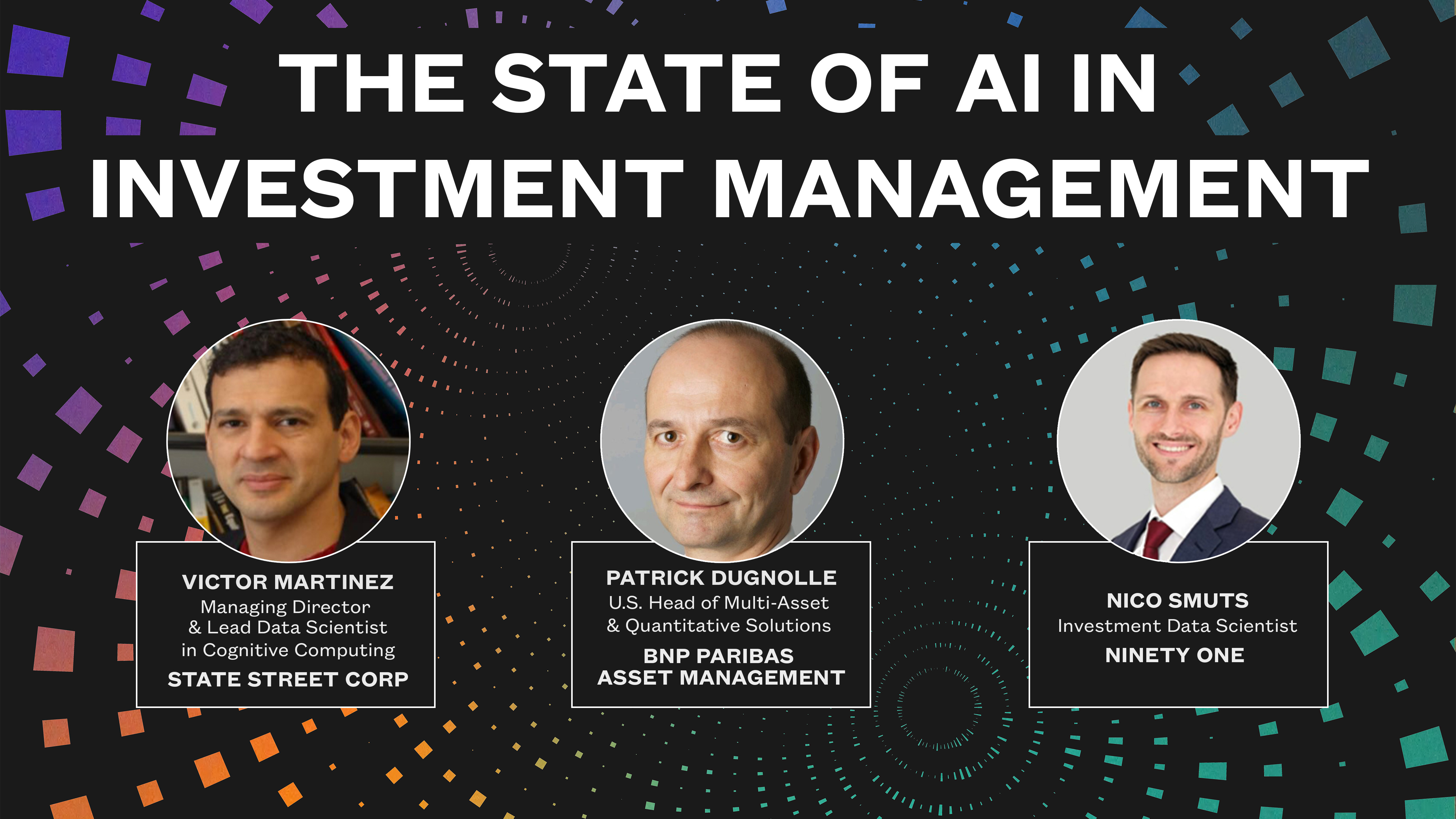

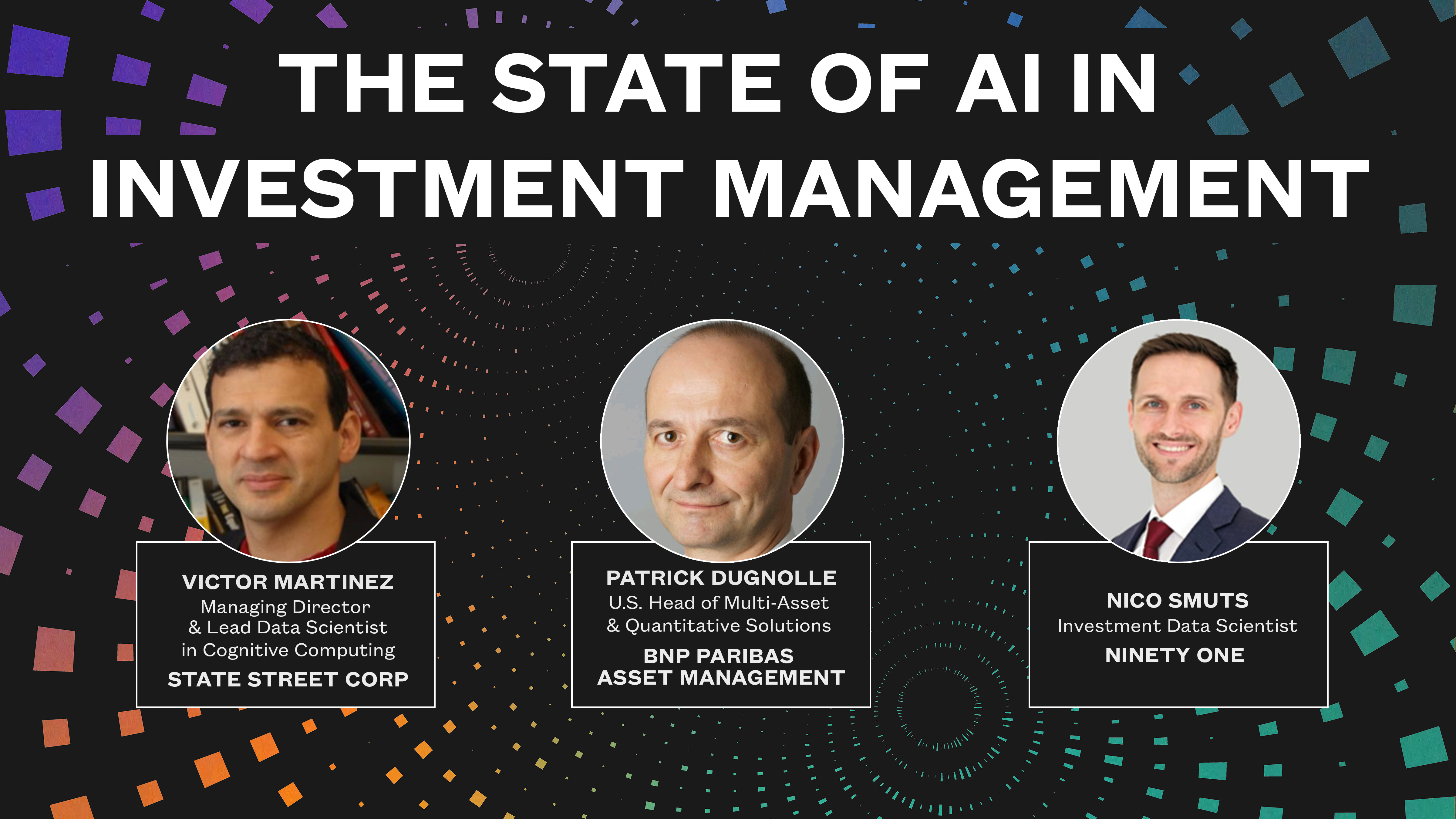

On this panel, industry experts (listed above) discussed the impact of COVID-19 on AI on Investment Management. We've included a short transcription of the panel, beginning at 22:46 of the webinar.

Patrick Dugnolle, BNP Paribas: So how do you believe that the COVID-19 crisis has affected the investment industry’s thinking around AI and investment management?

Nico Smuts, Ninety One: I'll take this first one. I think the one thing that's been very clear to me is that there has been a sort of passing interest in authentic data across the industry, but a lot of people that were on the fence or now are fully convinced that alternative data has a lot of value and should be incorporated in the investment process as part of the core process.

So just because the COVID crisis has moved so quickly, so much faster than a lot of standard economic indicators and forward-looking data points even, people have turned to things like road traffic, shipping data, electricity usage, carbon emissions, and of course the medical data that everyone's looking at. [They are] using all of those to get a picture of what's really going on. And I think when we were all waiting for that first industrial production print from China, everyone knew it was going to be bad. There was a good week or two before it came out and we could really assess the damage. There was just a flurry of activity of people turning to alternative data to try and triangulate where that number was going to come out. And I think that is going to lead to a permanent change in industry and a much bigger appetite for alternative data.

Victor Martinez, State Street Corp: Yeah, I will certainly agree with that. There are some examples in which you can see alternative data coming into the financial payment directly. For example, credit is one of those. You see some models in which applying a prediction of credit default or defaults in securities or in likelihood of companies degrading their credit ratings by, for example, looking at prospectus or looking at certain descriptive information on the web about a particular company. They have been able to infer, to a certain degree, that the increase or decrease in the full parole is for a particular entity or individuals for that matter too. So I think that those types of probabilities of increase or decrease of default certainly filters into pricing very directly.

Those are the kinds of models that will definitely help make an impact and certainly agree to the movement of prices in some way. So I would agree that that's something that is moving and then it's becoming more prevalent.

Patrick Dugnolle, BNP Paribas: There is one thing that is puzzling me on the current market conditions, and it's a very practical example. We've seen many low volatility strategies that were not performing as expected in the big top of the market recently. And that's kind of puzzling because you would expect clearly that those low volatility strategies are meant to be protective and to be defensive in that kind of market, so when they fail, it’s all the more troubling. Don't you think so?

Victor Martinez, State Street Corp: Oh, yeah. I think it goes back to this idea, to your point about changing correlation or time bearing changes in correlation, and that's a big part of it. I don’t know if Nico has a different perspective on that.

Nico Smuts, Ninety One: Yeah, I’ve been thinking about that and it’s something we've been following and we follow on an ongoing basis anyway. There are a lot of these systematic strategies that actually follow very simple algorithms, risk parity, CTA trained and carry strategies, etc. where they have to buy and sell according to a formula. And if too many funds follow the same formula, they actually exacerbate volatility in the market. So the classic example is with risk parity, funds and equity of all goes up. They have to sell down equities and buy bonds, and the more the equity market falls, vol goes up, they sell more, and so that leads to a much deeper depth.

I think this has shown the weakness of following a simple strategy. Especially if that strategy works and you have copycats, that leads to the point where we are now where so many investors try to do the same thing and it just puts additional stress on markets.

So I think we need to see more diversity in quantitative strategies. There's certainly a strong incentive, if you're running a quantitative strategy or start anything systematic, to bring additional inputs and not just have a simple formula so that it's more diversified and it doesn't seem to do the same traits that the rest of the market is doing on a given day.

Patrick Dugnolle, BNP Paribas: Would you have any other examples of, on the contrary, a failure in the current market conditions of AI tools you'd like to mention or you think?

Nico Smuts, Ninety One: I'll follow on from that example I mentioned, when COVID started in China and we were looking for the first kind of indications of how much economic activity had slowed down. On the Chinese mainland and the surrounding area, there was this lag where everyone was waiting for the data to come out, and one of the banks did some really good work by tracking the number of messages sent by ships. The ships sent their transmit bearing GPS coordinates, et cetera, on a regular basis, multiple times per second. And this very large dataset, multiple gigabytes or terabytes, was a mine for correlation with industrial activity. And that proved to be quite useful. So they brought their kind of a daily index of activity, which is much faster moving and proved to be really helpful.

I think creative uses of data that will, not necessarily predict the future, but give you a much better, clearer picture of what's happening at the moment and that's proving to be really helpful.

An additional example is this COVID crisis is almost like the same story playing out in lots of different markets with slight differences. And yet it's too time consuming to build a different model for every market. So building simple automated models that just fits a model to every country based on the latest available data is a huge win. And there are a lot of these kinds of dashboards that have gone up. We've also bought some internally that gives each team the data that's relevant to them, whether it's a fixed income team, an equity team, or the regional specialists. So they, AI has been very good at, not necessarily doing things better, but doing it faster and more scalable.

Recent Posts

5 Effective Risk Management Strategies When Trading in Crypto

Cryptocurrency has slowly made its way into the mainstream, and more people have begun thinking...

By Trix MejiaFebruary 25, 2022

The State of AI in Investment Management

On this panel, industry experts (listed above) discussed the affects of AI on Investment...

By Ai4April 22, 2020

The State of AI in Banking

On this panel, industry experts (listed above) discussed what they are most excited about...

By Ai4April 21, 2020